Do I Need To Start Making Estimated Federal Income Tax Payments?

Do I Need To Start Making Estimated Federal Income Tax Payments?

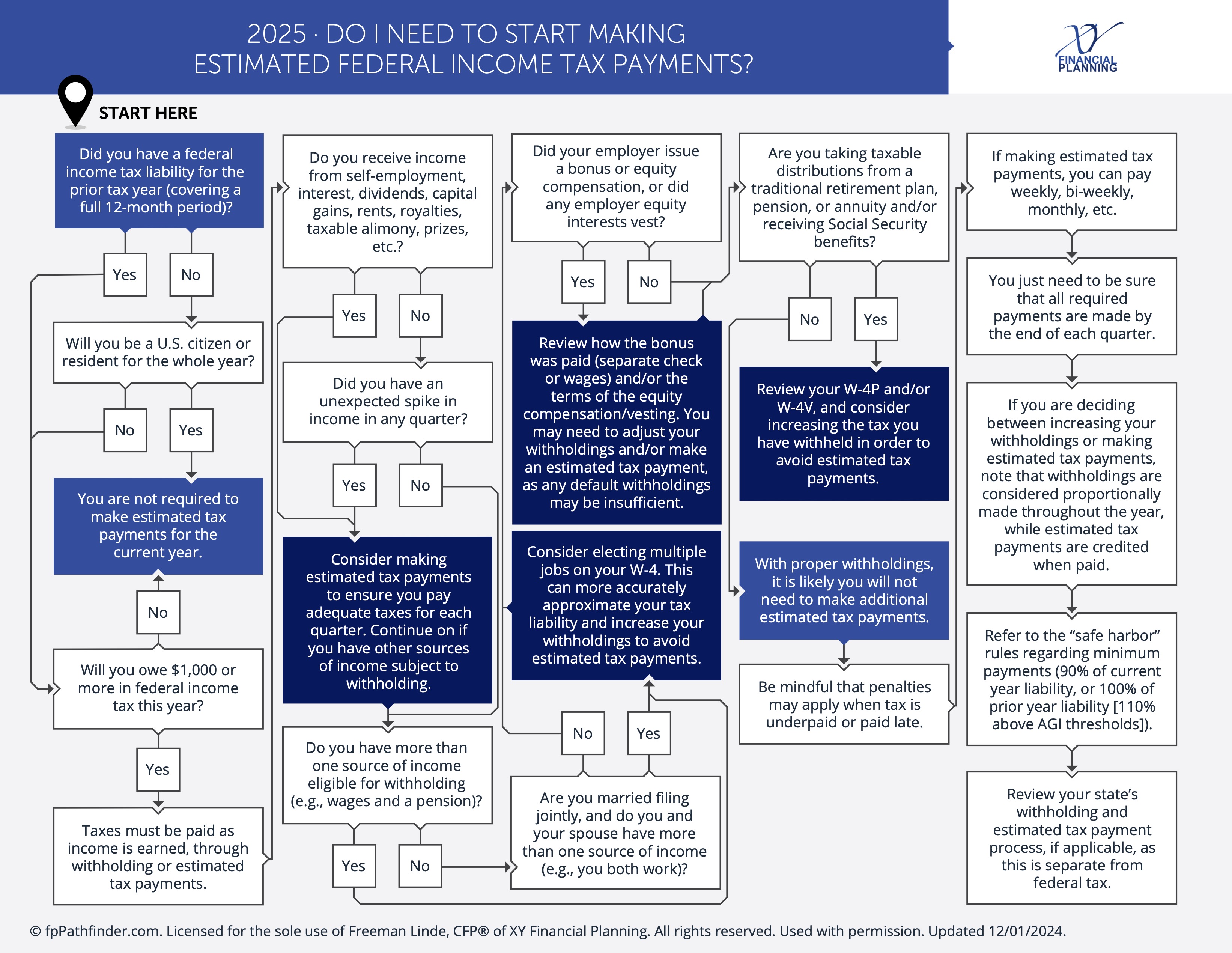

Do I Need To Start Making Estimated Federal Income Tax Payments? This flowchart will walk you through discovering your eligibility.

For many taxpayers, the prospect of making estimated federal income tax payments can seem daunting. However, understanding when and why these payments are necessary is crucial. Crucial for staying compliant with the tax laws and avoiding penalties. In this blog post, we’ll explore the circumstances under which individuals need to start making estimated federal income tax payments. We will also provide guidance on how to do so effectively.

Understanding Estimated Federal Income Tax Payments

Estimated federal income tax payments are periodic payments. These are made by individuals who anticipate owing taxes to the IRS beyond what is withheld from their paychecks, pensions, or other sources of income. These payments are typically made quarterly and serve to ensure that taxpayers meet their tax obligations throughout the year. Rather than waiting until the end of the tax year to settle their tax liabilities.

Who Needs to Make Estimated Tax Payments?

You may need to start making estimated federal income tax payments if:

- Self-Employed: If you’re self-employed and expect to owe $1,000 or more in taxes for the tax year after subtracting withholding and refundable credits. You generally need to make estimated tax payments.

- Additional Income: If you receive income that isn’t subject to withholding, such as investment income, rental income, or alimony, and you expect to owe $1,000 or more in taxes on this income, you should consider making estimated tax payments.

- Pension or Retirement Income: If you receive pension or retirement income and the amount withheld from your payments isn’t enough to cover your tax liability, you may need to make estimated tax payments to avoid underpayment penalties.

- Capital Gains: If you realize significant capital gains during the tax year and expect to owe taxes on these gains, you may need to make estimated tax payments to cover the resulting tax liability.

How to Make Estimated Tax Payments

Making estimated federal income tax payments is a relatively straightforward process. You can choose from several payment methods, including:

- Electronic Federal Tax Payment System (EFTPS): EFTPS is a free service provided by the U.S. Department of the Treasury that allows taxpayers to make federal tax payments online or by phone. To use EFTPS, you’ll need to enroll on the EFTPS website and schedule your payments in advance.

- IRS Direct Pay: IRS Direct Pay is another free online payment option that allows individuals to pay their taxes directly from their checking or savings account. You can access IRS Direct Pay through the IRS website and schedule one-time or recurring payments.

- Credit or Debit Card: The IRS also accepts tax payments by credit or debit card. You can make payments online, by phone, or through a third-party payment processor. Keep in mind that credit card payments may incur convenience fees.

- Check or Money Order: If you prefer to pay by check or money order, you can mail your payment along with a payment voucher to the IRS. Be sure to include your name, address, Social Security number, and tax year on your payment.

Conclusion

In conclusion, understanding when you need to start making estimated federal income tax payments is essential. This is for staying compliant with the tax laws and avoiding penalties. If you’re self-employed, receive additional income, have pension or retirement income, or realize significant capital gains, you may need to make estimated tax payments to cover your tax liability throughout the year. By familiarizing yourself with the rules and requirements for estimated tax payments and choosing the appropriate payment method, you can ensure that you meet your tax obligations and avoid unnecessary penalties.

See more flowcharts here!

This article is educational only and is not intended to be investment, legal, or tax advice or recommendations, whether direct or incidental. Again, this is not investment advice. Consult your financial, tax, and legal professionals for specific advice related to your specific situation. Never take investment advice from someone who doesn’t know you and your specific situation. All opinions expressed in this article are those of the people expressing them. Any performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be directly invested in.